An investor should make the right choices when choosing to invest in any asset or company. The right choice concerning investments can only be made when the investor does due diligence on the project they are investing in. It can further help in determining the amount of profit that can be generated out of that particular investment.

The due diligence of any commercial place like a hotel is very important. Not only does it include inspecting the physical aspects and condition of the place but also includes taking a good look at all the assets and liabilities associated with it before hotel investment. Knowing about how the hotel functions, its business model and its viability can help in deciding whether one should invest in it or not.

But due diligence is also a very technical practice that needs to be done well since one cannot afford to miss any important thing during this process. Following are the steps one should take to conduct due diligence before they invest in a hotel:

1. Checking The Legal Aspects

One of the first things one should do before investing in a hotel is to look at all the legal aspects related to it. It includes researching any past case filed against the property, its promoter, directors, members etc.

Knowing the legal history of the hotel will eventually help in establishing a relationship of trust. If a property has a long list of cases filed against it then that can be a cause for concern, and investment made on such a property would seem risky. There are some kinds of cases which may be ignored due to their less severe nature but the cases filed are mostly red flags.

2. Looking At The Business Background

Besides looking at the legal history of the business, it is also necessary to know how the hotel business is functioning as a whole. It includes getting relevant information about the basic business model, the people involved in it and if the business is profitable or can become and remain profitable in the long run. For this, one may need to contact a professional to guide them.

3. Checking Of All The Documents

While one chooses to invest in businesses like a hotel, where there exist a lot of chances of attracting liabilities, one needs to ensure that the business has all the required permission it is expected to have to function in the way it does.

These include documents like those used for incorporation of the company or the hotel and any other certificates, permits and licenses required for government approval. The documents must be genuine and should not be fake. Only then can one ensure that they are investing in the right place.

4. The Income Of The Business

After being sure about the genuinity of the hotel, another necessary aspect to consider is the amount of revenue or profit one might be able to generate if they invest in the property. It can be identified by knowing the net operating income of the hotel. The net operating income is found by removing the cost of operating the hotel from the total revenue generated by it.

The value obtained can be used to determine the profitability of that particular business which may lead one to investigate. An investor would want to invest in a property that generates the highest revenue while also having a higher net operating income. The net operating income can be calculated over a period of time like a month or a year. Having access to the hotel’s accounting documents can help in obtaining this information.

5. Per Room Income

Knowing the income per room can help in determining the actual financial strength of the hotel business. This value varies from hotel to hotel and hence is a great indicator that can help one decide which property they should invest in.

The amount taken by a hotel for one room does not only help in identifying the revenue that can be earned by the business at once but also helps in finding out the demand that the business might be generating along with the popularity of the location the property is built on. All these factors can lead one to believe that as the prices of the property rises, so can the per-room income

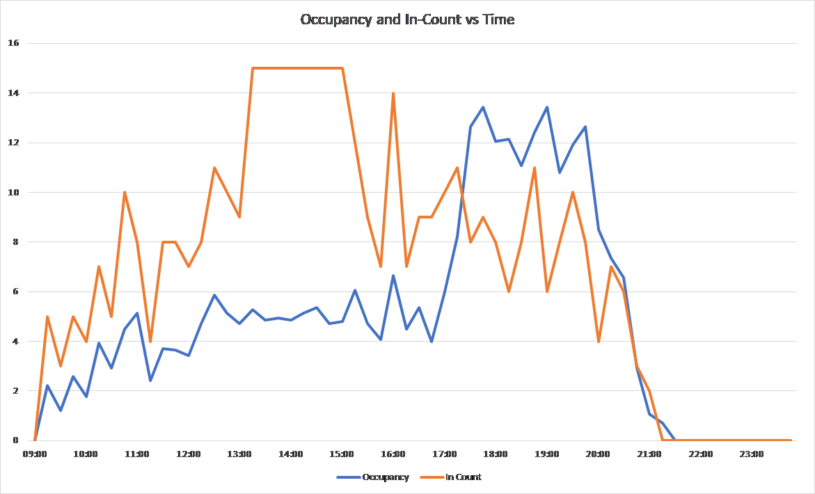

6. Daily Footfall and Occupancy

It is another factor which helps one in determining the demand for the rooms on the property. It eventually helps in determining how successful the hotel business is at the moment. Such records can be found by contacting the management before investing.

A hotel which has a higher footfall can be said to be more in demand and more successful and hence is a better investment option than a property which does not have that kind of occupancy rate. It can also help in determining the future scope of the project as a hotel which has very high demand and footfall might be able to expand its property and business in the future generating more income.

Conclusion

Investing in a revenue-generating and continuous project like a hotel can be a great option for any investor. Besides normal losses that can be faced by such businesses during events like the covid, such businesses generally remain profitable once they become cash positive. This means that they can act as a constant source of growth and income for the investor.

But before investing in just any hotel that one comes across, it is important to first do the due diligence on it. Due diligence of the property refers to taking the right steps to inspect the place or property one is looking to invest in. The due diligence of a place like a hotel is also very important as one needs to focus not only on the physical aspects of the business but should also look at its financial health and the needed legal requirements.